The Illusion of Wealth, The Reality of Debt

Vedanta Limited, led by Anil Agrawal, claims to be at the forefront of India’s industrial transformation. But beneath the glossy headlines and press releases lies a crumbling financial reality:

₹73,853 crores in consolidated debt as of 31 March 2025.

Promoter shares are almost entirely pledged.

Standalone debt of Vedanta Limited: ₹42,821 crores.

And yet… investment promises totaling over ₹1.82 lakh crores.

₹1.2 lakh crore in Odisha

₹12,000 crore in Hindustan Zinc Limited (HZL)

₹50,000 crore in Assam

Is this empire run on cash flow or castles in the air?

🔎 Hindustan Zinc: From Net Cash to Net Debt?

Let’s set the record straight:

📊 Hindustan Zinc Ltd (HZL) – Official Data

March 31, 2025:

Debt: ₹10,651 crores

Cash & Equivalents: ₹9,482 crores

Net Debt: ₹1,169 crores

March 31, 2024:

Debt: ₹12,270 crores

Cash & Equivalents: ₹8,153 crores

Net Debt: ₹4,117 crores

A year ago, HZL had a net cash balance. Today, it’s slowly sinking — not because of its own business weakness, but because it’s being milked to feed its parent, Vedanta Resources Limited (VRL).

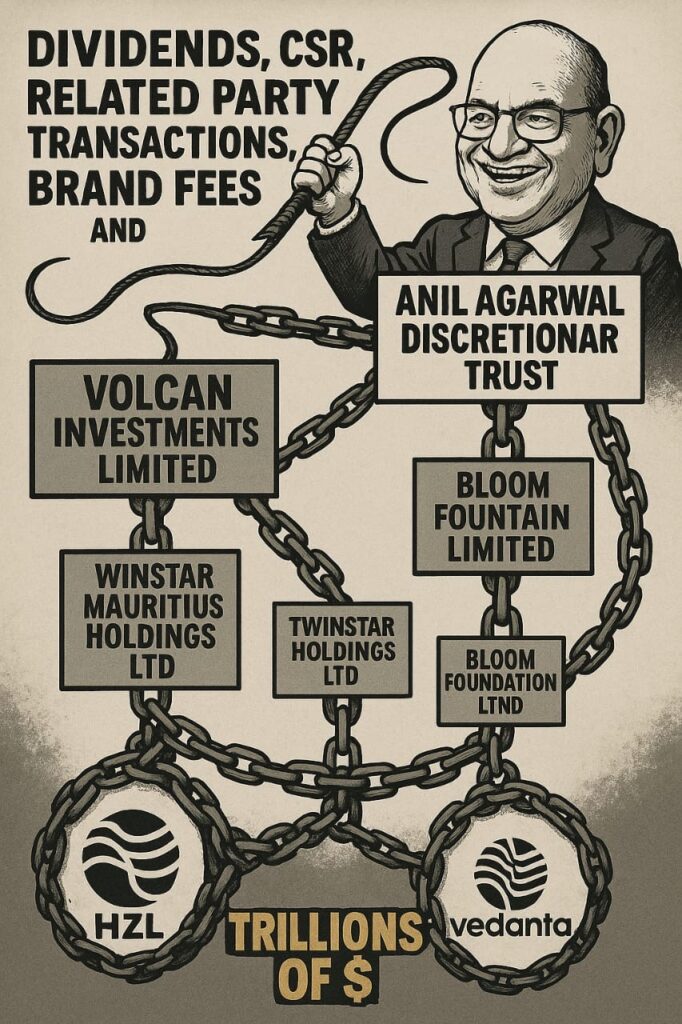

🚨 The Chain of Violations

Vedanta’s methods are not just questionable — they are in direct violation of corporate laws and public interest:

- Section 123 of Companies Act violated: Excessive dividends declared just to transfer cash to VRL.

- Section 188 violated: Brand fees, service fees, and related party transactions charged from HZL to parent/promoter group.

- Shareholder Agreement (Clause 4.5) breached: HZL’s reserves diverted without board independence or transparency.

- HZL CSR Funds donated to Vedanta Foundation & Anil Agrawal Foundation — a clear conflict of interest and misuse of public resources.

- Dividends pledged to raise private loans — a public company’s profits used as collateral for private empire-building.

🧿 If Vedanta Has So Much Money, Why…

Did it sell 1.6% stake in HZL recently?

Is it signing facility agreements and issuing NCDs just to survive?

Are public institutions silent when shareholder wealth is being compromised?

If Anil Agrawal truly has access to unlimited funds, as claimed in flashy MoUs and media propaganda, then why not make Vedanta a debt-free company first?

Or…

Has Kuber himself handed his treasure keys to this “bania”?

🕵️♂️ Where Will the Money Come From?

Let’s examine the possibilities:

FDI via Shell Companies from Mauritius, Singapore?

Commercial Borrowings routed through shady subsidiaries like Bloom Fountain or Twinstar?

IPO proceeds from demerged units listed on Indian bourses via SEBI?

Soft loans from Indian PSU banks and NBFCs?

None of this is transparent. Everything smells like a financial shell game.

🧱 Institutional Collapse: Who Will Audit the Loot?

Despite repeated red flags, there’s no action from:

CAG: No special audit of HZL or BALCO

SEBI: No enforcement on disclosures and pledging

MCA: No inquiry into related-party transactions

ED/SFIO/CBI: No investigation into violations under Companies Act, FEMA, PMLA

PMO/NITI Aayog: Total silence

India is watching its mineral wealth being hijacked — and the government is watching silently.

📢 What Must Be Done?

- CAG Audit of all disinvested PSUs: HZL, BALCO

- SEBI Probe into share pledging, dividend manipulation, and demerger-linked IPOs

- SFIO & ED Action under relevant provisions

- CBI Investigation into money routing via subsidiaries

- Stop all stake sales and demergers until complete forensic disclosures

🚨 This is not just another corporate scam.

This is a national wealth capture operation — orchestrated by debt, deception, and deliberate institutional inaction.

And unless we act now, the public stake in India’s mineral future may be lost forever.